Deciding what to invest in can be daunting. There are the obvious candidates, such as traditional stocks and bonds, or simply leaving cash in a savings account. But those are by no means the only options – nor should they be.

Creating a robust portfolio by diversifying your investments across a range of different assets is essential. Investors today have plenty of other choices including real estate, cryptocurrencies, private equity and more.

Of these, private equity is a key asset class to consider. Here, we explain what it is and why it plays such an important role in investment portfolios.

What is private equity?

Private equity refers to a stake in a company that is privately owned i.e. its shares are not listed on a stock exchange. Investors often invest through funds which in turn invest in private investment opportunities.

Private equity is considered an “alternative” asset class. Investors have plenty of choice within the private equity bracket. For example, there’s:

- venture capital - investing in young but fast-growing companies

- growth capital or leveraged buyouts – investing in more established and cash-generating businesses

- private debt – investing in the debt instruments issued by these companies, or

- private equity real estate – backing real estate investments or infrastructure projects.

Private equity funds are set up as closed-end limited partnerships. Investors hand over the management of the fund to a fund manager which actively manages the fund’s investments. Liquidity is limited because there is no formal secondary market for investors’ interests in private equity funds. Private equity funds usually have a 10–12-year life, after which they are usually liquidated.

What kinds of returns can investors expect?

Private equity typically has higher returns potential than other assets classes such as public equities traded on the stock market, bonds or property. This scope for outperformance versus public markets is largely confirmed by empirical research. For example:

According to analysis from the Chartered Alternative Investment Analyst Association, private equity allocations by US state pensions produced an 11.0% net-of-fee annualised return over a 21-year period ending June 30, 2021. This is compared to a 6.9% annualised return that would have been earned by investing in public stocks.

How much of an investment portfolio should be allocated to private equity?

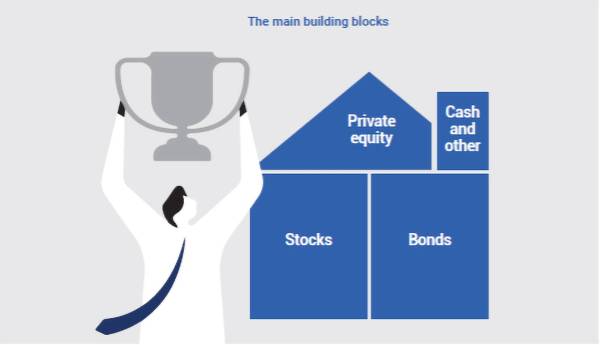

So, what proportion of a portfolio should private equity represent, and else should be included in the mix? There is no one-size-fits-all answer: it depends on each investors’ timeframe and risk appetite. However, in order to produce inflation-beating returns on a consistent basis, these are the basic building blocks:

Stocks and bonds should be the foundation of any investor’s long-term portfolio, as both provide liquidity and global diversification.

Private equity should make up a substantial part of the portfolio, given its ability to provide diversification and superior return potential.

Cash should form a residual allocation to provide liquidity so investment opportunities can be seized when they arise.

Niche asset classes such as art, collectibles, and digital assets, can also be included to a limited degree, depending on every individual’s interests and wishes.

A portfolio with those characteristics should smooth out risk and drive returns, beating inflation consistently over the long term, while keeping sufficient liquidity available for whenever it might be needed.

For investors, this approach is smart and sensible. Private equity may be classed as an ‘alternative’ asset, but in reality, it should be a core component of any well-constructed, balanced portfolio. The next question is: how can investors access such opportunities?

To find out, download our guide.